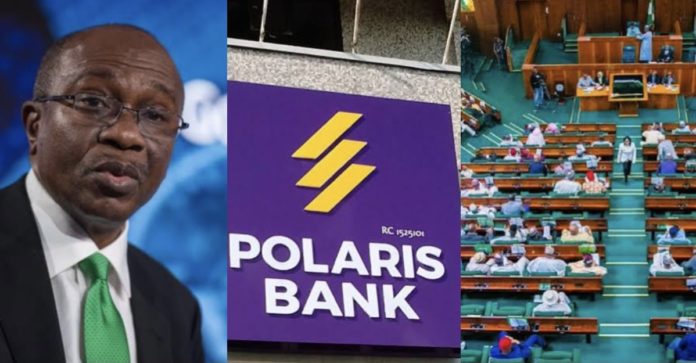

The House of Representatives on Wednesday ordered the Central Bank of Nigeria to halt plans to sell Polaris Bank Plc.

The lawmakers, who moved against the secret sale of the bank, directed the CBN to resume the bidding process after the Nigeria Deposit Insurance Corporation (NDIC) and the Asset Management Corporation of Nigeria (AMCON) concluded all processes for open, transparent, and competitive bid process.

According to the legislators, this is in line with best practice and procedure for divestment of this nature.

Earlier, Henry Nwauba (APGA-Imo) adopted a motion of urgent public importance at the Wednesday plenary.

According to him, public attention had been drawn through a circulation currently on social media in respect of the proposed sale of Polaris Bank for N40 billion.

Nwauba stressed on the importance of making sure that the divestment in the bank did not jeopardise the core reason for the CBN intervention in the bank in the overall public interest.

The legislator also insisted on the transparency of the process and following the required due process.

READ ALSO: Nollywood Film-maker Seun Egbegbe, Set Free After Spending 6 Years In Prison

He warned that ignoring due process will affect the trust from critical stakeholders in the economy, foreign business partners, banking community, depositors and correspondent banks.

He added that it was crucial to avoid the shortcomings of a previous similar exercise undertaken in the past which birthed Polaris Bank from the defunct Skye Bank Plc.

This, he said, was for which close to a trillion naira of public fund was committed to resuscitating the bank.

He said that the proposed sale was shrouded In secrecy and was opaque and required that it was done in transparency and accountability to eliminate insinuations of corruption.

He said the transited defunct Skye Bank was a systemically important bank with a large pool of employees, customers, and other stakeholders.

He said that the bank without a bailout would have had a serious contagion effect on the economy and global perception/reputation.

The House therefore set up an ad hoc committee to within 20 days, review the total outlay by the Federal Government of Nigeria in Polaris Bank and account for the entire financial input in the bank by the Federal Government.

The House said this should be through CBN, NDIC and AMCON to determine whether the conditions and terms of sale were likely to ensure positive return on public funds thus far committed to the bank, whether as bailout funds or other investments.

The House then urged the committee to take any action necessary to ensure that the public funds committed to Polaris Bank were appropriately documented and accounted for.